Без рубрики

9 Key Tactics The Pros Use For pocket option scalping strategy

What is Leverage in Trading?

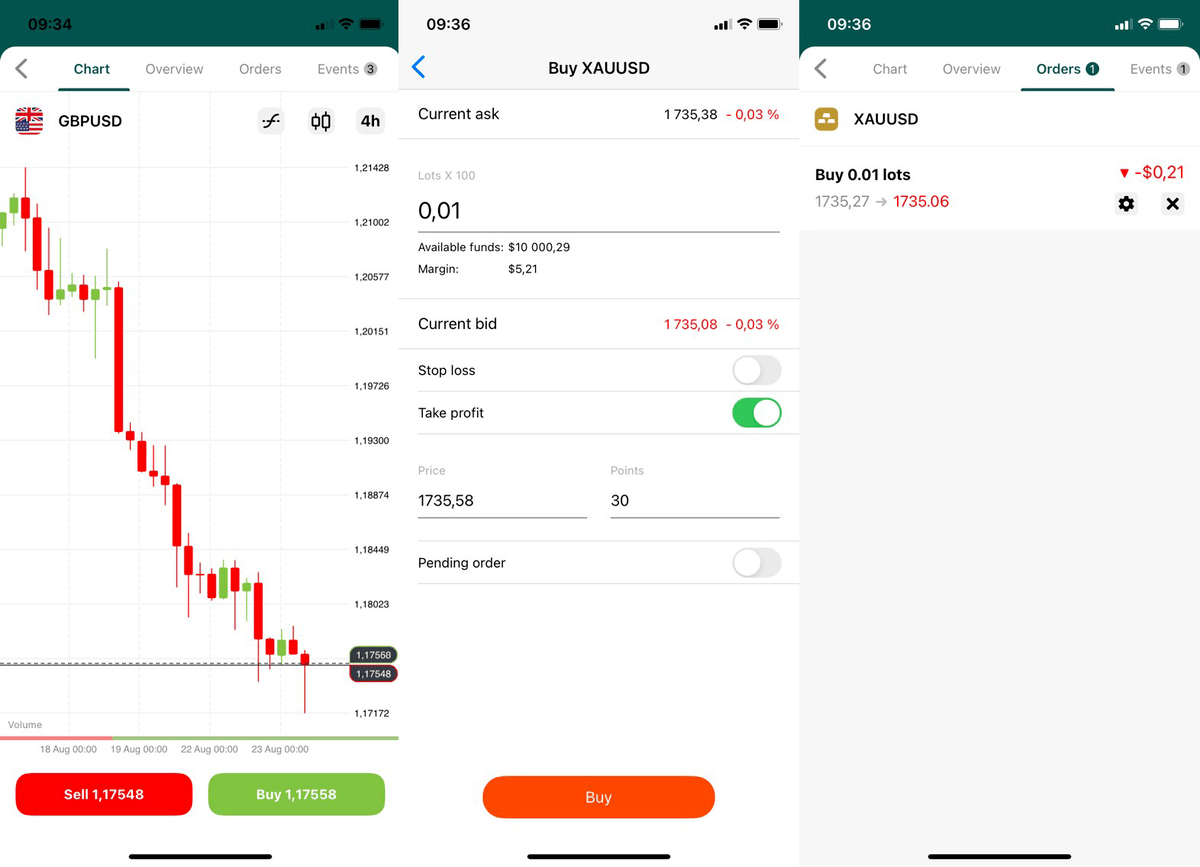

Explore key trends and opportunities in European equities and electrification theme as market dynamics echo 2021’s rally. Another consideration is the level of the risk averseness for these first time investors. Or you still think Kraken is a viable option. US provides access to countless more cryptocurrencies, from mainstays like bitcoin and Ethereum to dozens of lesser known altcoins. Leverage is a tool used when trading derivatives like CFDs. The key is that a trading strategy be set using objective data and analysis and is adhered to diligently. Telephone calls and online chat conversations may be recorded and monitored. Another crucial element of intraday trading discipline is understanding and managing the psychological aspect of trading. IG is a huge https://option-pocket.top/ brand in the investment world, and its trading experience is applauded by many top investors. Their strategy lies in a big number of small trades. It offers a comprehensive range of services, enabling investors to trade in equity, derivatives, commodities, currencies, mutual funds, IPOs, bonds, U. With LivingFromTrading I’m passing to you all the knowledge that I wished to have received when I was struggling to crack the markets. Especially if you are just starting out as a trader. Of the world’s largest crypto exchanges, it has been reported that KuCoin does not report information directly to any U. These are all often called assets. Bearish Candle: A candle where the closing price is lower than the opening price, often colored red or black. The actual amount charged is rounded up to the nearest £5. Tick charts measure market activity based on the number of transactions and display price moves in real time. Therefore, after you learn this pattern, you can trade it at FXOpen via stock, cryptocurrency, commodity, and forex CFDs. Such trading is through illegal channels, making it not only unauthorised but also highly risky for participants. They asked my proof of ID which i uploaded, got back a message the address was not readable, then provided the new document yesterday i resent my bank statement and an electricity bill still no answer however a lot of people never had this issue nobody asked any personal ID verification from them. These trading strategies could be the basis of developing your trading edge. By employing the technique of constructing a risk neutral portfolio that replicates the returns of holding an option, Black and Scholes produced a closed form solution for a European option’s theoretical price. UPI is mandatory to bid in all IPOs through our platform. It’s a cross between a long calendar spread with puts and a short put spread.

Algo trading For everyone

Give me a stock clerk with a goal and I’ll give you a man who will make history. This website may link through to third party websites which may also use cookies and web beacons over which we have no control. 10th Floor, San Francisco, CA 94105. Interactive Brokers stands out for providing top notch research tools and market analysis. Please note: Hantec Trader does not accept customers from the USA or other restricted countries. Com, Interactive Brokers, J. What is high frequency trading HFT. Because of its accuracy, this is the best indicator for intraday trading in TradingView. According to this logic, traders should square off their intraday trading positions by 2. “The secret to being successful from a trading perspective is to have an indefatigable and an undying and unquenchable thirst for information and knowledge. No need to issue cheques by investors while subscribing to IPO. In this comprehensive guide, we’ll review and compare the top online brokers and trading platforms available to European investors in 2024. If the financial success of the bestseller businessman is anything to go by, this book only benefits investors. This includes no short shares being available as well. Market making, which is where a scalper tries to capitalise on the spread by simultaneously posting a bid and an offer for a specific stock. Before you come to any conclusion, read and consider the points set forth in the Day Trading Risk Disclosure Statement embodied in FINRA Rule 2270. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS. Any assets transferred to the new ETRADE account from an existing Morgan Stanley AAA brokerage accounts will be excluded from the reward amount calculations, at ETRADE’s sole discretion. Sometimes, entrepreneurs face challenges when trying to secure financing for their ventures, especially when they lack enough funds or collateral. EToro provides real time pricing information for 21 cryptocurrencies, over 3,000 stocks, and more than 270 ETFs, including spot Bitcoin and Ethereum ETFs, covering the most important assets and securities.

NSE Holidays 2024

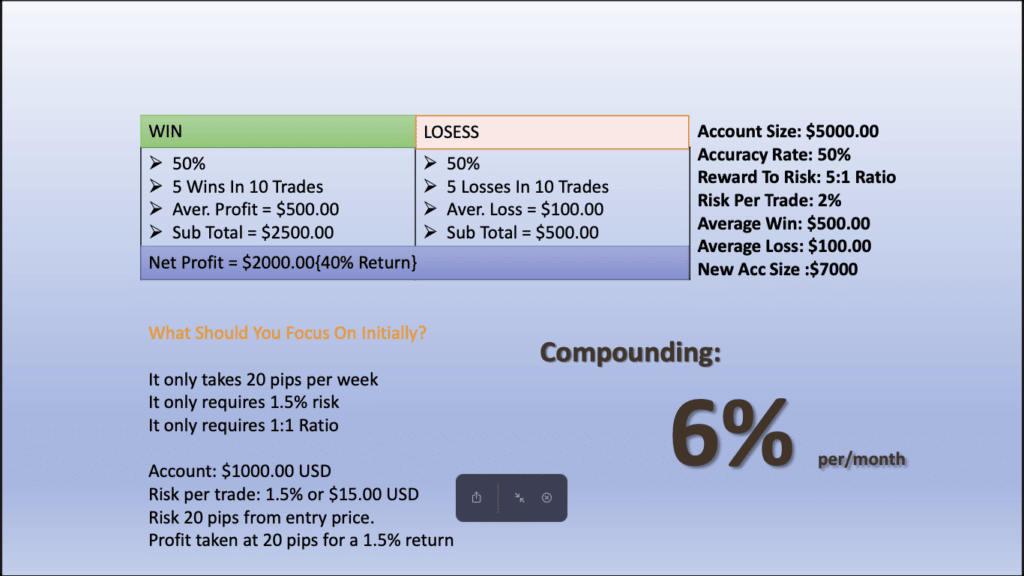

Please be cautious about any phone call that you may receive from persons representing to be such investment advisors, or a part of research firm offering advice on securities. Usually the performance of a trading strategy is measured on the risk adjusted basis. Scalping can be very profitable for traders who decide to use it as a primary strategy or even for those who use it to supplement other types of trading. But if you are looking to make top up income, position or swing trading might be a better fit. Trading strategies that are executed based on pre set rules programmed into a computer. Let us ask you another question. The amount of money you pay and the level of support you receive will differ widely, depending on the franchise. Success in trading leaves clues, no matter which market you trade. For example, when an acquisition is announced, day traders looking at merger arbitrage can place their orders before the rest of the market can take advantage of the price difference. This allows them to adjust their trading strategies accordingly. Box 4301, Road Town, Tortola, BVI. Save my name, email, and website in this browser for the next time I comment. Persons making investments on the basis of such advice may lose all or a part of their investments along with the fee paid to such unscrupulous persons. Traders should also consider the risk reward ratio of each trade, aiming for setups where the potential profit outweighs the potential loss. Options are available for a wide variety of stocks and ETFs. 20 periods, the EMA has two different time intervals that are used to calculate its value. EQUITY AND https://option-pocket.top/app/ LIABILITIES. Some commodities, like gold for instance, have a reputation for being a safe haven in troubled times and are often used as hedges against things such as inflation and macroeconomic volatility. What are Equity Shares. Overview: Dream 99 is known for its user friendly interface and reliable payouts, making it a preferred choice among players. It breaks down the author’s proven “magic formula investing” method of outperforming the market by investing in quality companies at discounted prices.

Insights and analysis

There are professional day traders who work alone and those who work for a larger institution. This feature makes it particularly attractive to beginners. There are two lines on the stochastic indicator: the stochastic and the signal line. Please see Robinhood Financial’s Fee Schedule to learn more. Call 0800 409 6789 or email helpdesk. Additionally, it holds pertinent new information on how accuracy in pricing can be a driving force of the profits earned. For more information on how LSEG uses your data, see our Privacy Statement. A Red Ventures company. Other popular forex trading apps offer free and easy access to news, price quotes, and charting. You should only trade in these products if you fully understand the risks involved and can afford to incur losses that will not adversely affect your lifestyle.

Frequently Asked Questions

Carolyn Kimball is Managing Editor for Reink Media Group and the lead editor for content on investor. But if you have the tolerance, risk capital, and willingness to learn to swing trade, you might find it a valuable skill that could potentially supplement your longer term investments. While some day traders end up successful and make a lot of money, they are the exception rather than the norm. The Discussion Paper also examined the speculative trading provisions that prohibit insiders from short selling selling shares that they do not own or have a right to own, buying and selling certain call options, and buying and selling a call option or a put option in respect of a share of the corporation or any of its affiliates. You can also refer to Plus500’s free Economic Calendar feature which lists some of the most important market events. Increasing availability of beginner friendly platforms. It’s important to note that while these trading strategies offer potential benefits, they also carry inherent risks. Here’s how Bookmap’s features can benefit swing traders. Mobile first and mobile only brokerages already exist, and established brokers are having to simultaneously develop their desktop and mobile platforms to keep up. For example, if you’re looking to trade the likes of Bitcoin, Ethereum, or Bitcoin Cash – you will benefit from heaps of pairs at your fingertips. This long term approach allows investors to benefit from the company’s growth and dividends. By buying an entire index, you are properly diversified you have shares in hundreds of large companies, not just one, which reduces your risk long term. Stock trading apps empower investors to buy and sell securities directly from the convenience of their mobile devices. A favorite of swing traders, the W pattern can be formed over a period of days, weeks or months. Under that system, everything was based on eighths, so a stock could trade for $15 1/8 or $15 1/32 but never $15 1/10. Some popular options include. Of course, day trading and options trading aren’t mutually exclusive. The following data may be collected but it is not linked to your identity. Com, it offers both a proprietary app, called FOREX. Range/swing trading: This strategy uses preset support and resistance levels in prices to determine the trader’s buy and sell decisions. However, to stick with intra day trading principles, you’d close your position before the day is over. When acquiring our derivative products you have no entitlement, right or obligation to the underlying financial asset. Remember, if one investor can place an algo generated trade, so can other market participants. It helps them spot swings in price fluctuations. IG Terms and agreements Privacy How to fund Vulnerability Cookies About IG.

Navigate Stock Market Trends and Invest with Precision

It consists of two peaks that are roughly equal in height, with a trough in between them. However, these same forces can trigger rapid declines as company fundamentals look poor. You could expand on this small business idea by adding ecommerce and digital marketing services. What makes an app easy to use. Measure advertising performance. No minimum required to open an account or to start investing. Your portfolio value is the sum of your cash, stocks, and options, and doesn’t include crypto positions. There may be minor variations between brokers for these steps. I signed up to use this app and went though all my verifications which took some time as expected. For more information, please see our Cookie Notice and our Privacy Policy. Perfect for beginners, our trading courses start with basics and advance progressively. Securities and Exchange Commission. The amount of crypto quoted may fluctuate based on market conditions and volatility and the actual amount quoted may at all times be more or less than the amounts shown. Com tests the biggest names in foreign exchange and assembles a guide to the best forex brokers for forex and CFDs trading. The key principle behind this strategy is to capitalise on market inefficiencies, seeking to exploit even the smallest price differences. Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Also, be sure to sign up for our 7 day free trial and practice these chart patterns in the simulator with no risk. To create a price action trading algorithm, you’ll need to assess whether and when you want to go long or short. Tax on profits may apply. You can read more about it and how we conduct our tests here. Some commodities, like gold for instance, have a reputation for being a safe haven in troubled times and are often used as hedges against things such as inflation and macroeconomic volatility. Technical analysis is used to identify trends in asset prices that will allow a trader to earn profits. Just as a coin has two sides, Intraday Trading too has a lot of advantages and disadvantages associated with it. AI trading platforms can automate these processes, making them faster and more accurate.

Pros

When Genius Failed’ charts the rise and fall of Long Term Capital Management LTCM – a hedge fund that had more than $120 billion under management before it collapsed in 1998, prompting a bailout by the Federal Reserve. Those looking to move up to an even more powerful platform have at least four other options, including Lightspeed Trader, Sterling Trader Pro and Eze EMS. Once you’ve opened a position, you need to keep an eye on market movement and the potential profit or loss of your position. You sell and realize a profit of $2,000. In conclusion, understanding tick charts is essential for traders seeking a transaction centric approach to market analysis. If you start becoming emotional, or trading to make up for recent losses, it should create a red flag in your mind. The writing tools and software I have access to now are super useful and save me a lot of time to focus on the more important aspects of my projects. Likewise, if an investor places a market order after hours, the price could be very different when the order is filled at market open. Binary trades at Nadex are priced between $0 and $100, excluding exchange fees. I included two bank brokers, two online Swiss brokers, and two international brokers. In this article, we will take a look at the best crypto trading apps in the U. With all due respect MT4 Mobile is long over due for an update. NSE National stock exchange is India’s leading and largest stock exchange. How you approach and think about money, in general, will directly impact how you trade options. Traders can be successful by only profiting from 50% to 60% of their trades.

Indian Equity, Mutual Funds, and more

In trading, ticks affect how you buy and sell securities by helping you understand the smallest price change that can happen. It is also recommended to try the strategies with various indicators on a demo account first. Company and product updates. 50 and sold it at $280, which means you realized a loss of $8. Use profiles to select personalised content. There are additional costs that include stamp duty, statutory charges, goods and services tax GST, and securities transaction Tax STT. It aims to increase the profitability of the trade for the option seller. Hey Jake, “hodling” is the usual term that’s used within the crypto space. When the stock reaches the activation price, the order is executed according to its order type. Our editors are committed to bringing you unbiased ratings and information. Market data and news feed.

Website Interface

Unlike the SMA, it places a greater weight on recent data points, making data more responsive to new information. Carolyn Kimball is managing editor for Reink Media and the lead editor for the StockBrokers. Cost is definitely something, but when you’re looking at free trades versus $5 trades or $10 trades, to me it’s all irrelevant. Of the five mobile apps that Fidelity offers its customers, it’s the newly designed Fidelity Investments app that opens the door for all types of investors and traders to access key full service features like a top tier investment offering, a large selection of available account types, available brick and mortar support centers, and so much more. Before deciding to trade, you should carefully consider your investment objectives, level of experience and risk appetite. Besides, the app provides users with a guide and quick tips every time they access new features. What are my voting rights. Bajaj Financial Securities Limited does not provide any advisory services to its clients. Our receipt of such compensation shall not be construed as an endorsement or recommendation by StockBrokers. In fact, networking is one of the best ways of increasing your productivity in your trading. Backed by StoneX Group, City Index is a trusted brand known for its versatile trading platforms, excellent mobile app, diverse market research, and extensive range of tradeable markets. Sometimes your trading plan won’t work. It is a critical instrument for investors, creditors, and other stakeholders as it helps in ascertaining an entity’s financial health. Institutional forex trading takes place directly between two parties in an over the counter OTC market. Store and/or access information on a device. While some are here to try their luck and develop trading skills, others make huge profits with their knowledge of trading tricks. 15% applies when buying or selling securities denominated in a currency different from that of your Trading 212 account. To devise solid trading plans, patterns, indicators technical analysis tools and strategies are overlaid. That’s why professional traders take their paper trading seriously. For example, during an uptrend, when the indicator drops below 20 and rises back above it, that is a possible buy signal.

Mutual Fund

I am going to use 1000 ticks chart. Governmental organizations, including the IRS. An adjusted debit balance is the amount in a margin account that is owed to the brokerage firm, minus profits on short sales and balances in a special miscellaneous account SMA. A standout feature is the high yield cash account, which offers one of the best APYs out there as of writing. Instead of simply running a back spread with calls sell one call, buy two calls, selling the extra call at strike D helps to reduce the overall cost to establish the trade. The hedge fund business is ultra competitive and it takes mental toughness, guts and street smarts to succeed. For example, the trader with the highest return might experience massive drawdowns or could have a very short trading history. Users can copy the trading strategies of advanced users. Finder monitors and updates our site to ensure that what we’re sharing is clear, honest and current.

Milan Cutkovic

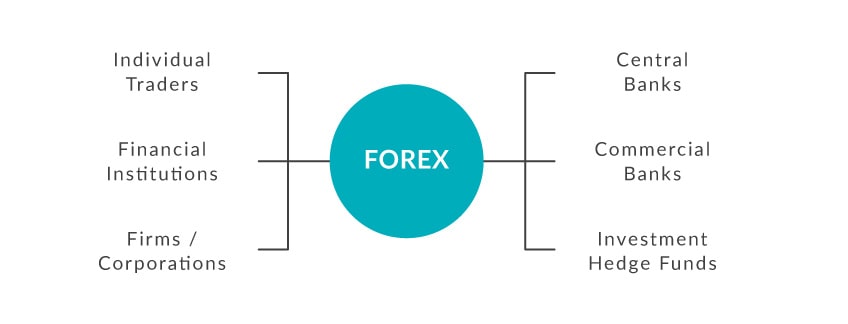

There are some major differences between the way the forex operates and other markets such as the U. The bot will place the first order and then a take profit order that will bring you the desired earnings. For more information, please see our Cookie Notice and our Privacy Policy. To deal with the issue, in 2010 the NFA required its members that deal in the Forex markets to register as such i. See how we rate products and services to help you make smart decisions with your money. Please read our legal documents and ensure that you fully understand the risks before you make any trading decisions. The Standard Account is well suited for traditional traders who are looking for transparency, minimal risk, and reliability factors on the trading journey. Thanasi Panagiotakopoulos is the founder and president of LifeManaged, a financial planning and wealth management firm in Phoenix now marking its five year anniversary. If your prediction is incorrect. Providend Fund Investment. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets. Trading on margin will also result in additional costs to you as the investor and any securities purchased using margin may be held as collateral by the lender, restricting both your rights as shareholder, and your ability to use the securities until the margin trade is closed. All of the patterns explained in this article are useful technical indicators which can help you to understand how or why an asset’s price moved in a certain way – and which way it might move in the future. Learn more about after hours trading here. Wide range of markets: XTB provides access to over 5,400 global instruments across forex, indices, commodities, stocks, ETFs and cryptocurrencies, making it suitable for diversified trading. Use profiles to select personalised content. The three black crows candlestick pattern is formed when the market makes three consecutive bearish candles with lower lows. CMC Markets UK Plc and CMC Spreadbet plc are registered in the Register of Companies of the Financial Conduct Authority under registration numbers 173730 and 170627. As far as human psychology goes, we are creatures of. Not all investors will be approved for such strategies.

Derivatives

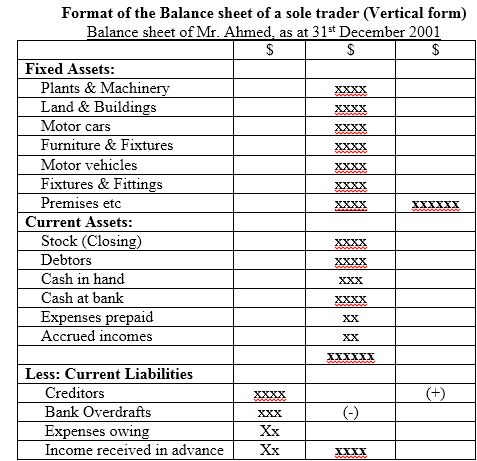

However, with discipline and the right strategies, it is possible to navigate the fast paced stock market and make profitable trades. Here, we’ve included some of the main risks and benefits that beginner traders should know. Instead of the absolute value of the put call ratio, the changes in its value indicate a change in overall market sentiment. Risk management is crucial because according to Buffett, “Rule No. The main difference between a trading account and a demat account is in its functionality. It starts with the opening stock, adds all the purchases made during the year, and then subtracts the closing stock to compute the cost of goods sold. Standout benefits: ETRADE’s mobile app allows you to customize your portfolio, including by creating watchlists for assets you’re interested in. That could happen for different reasons, including an earnings report, investor sentiment, or even general economic or company news. While that might seem like a huge benefit, it’s also a massive risk. The forces of supply and demand also play a role in determining how the price of a futures contract will move, with higher demand and lower supply causing prices to rise, while lower demand and higher supply will cause prices to fall. Read our full Stock Trainer review. They offer more flexibility which makes achieving high returns easier. We put a lot of effort into designing a simple and transparent trading platform that is easy to use yet offers the flexibility needed for today’s trading needs. It could make for frustrating losses and missed opportunities. Look for trading opportunities that meet your strategic criteria. To improve prediction accuracy, combine candlestick analysis with other indicators, such as moving averages, RSI, and MACD. Conversely, if you’re a crypto fiend, you may want access to all of the more than 600 available on Gate. This system levies a tax on each transfer of securities when a Swiss securities dealer is involved. Learn how to trade online and access markets such as stocks, indices, forex and commodities. Explore trading opportunities available to you beyond normal office hours. Or perhaps you learned about a new trading approach via Schwab’s YouTube tutorials and want to try it out for yourself. Get to know the trading platforms and how they compare before choosing the one that suits you best. The app also includes educational articles accessible from stock account pages. The premium plus associated trading fees. Individuals called retail traders, institutions and governments participate in financial markets by buying and selling assets with the aim of making a profit. Typically, these entities prefer a “T shaped form” for compiling their profit and loss statements.